This is the ultimate guide to the UAE tax registration number (TRN) by the VAT expert in Dubai.

So, if you want to avoid VAT fine from the Federal Tax Authority, you’ll love this guide.

Let’s get started.

What is a Tax Registration Number (TRN)?

Tax Registration Number or TRN is a special number assigned to every company that registers for VAT in UAE.

Federal Tax authorities give tax numbers to differentiate records of one company from another.

Companies must mention this VAT number in every VAT return, Tax Credit Note, Tax Invoice, etc.

In other words, it is your VAT identification number, a specific number that you need to consider for the trade. For example…

Do you sell products and services? Then it necessary for you to mention it on your sales invoices.

Are you a buyer? Then you will only pay tax to vat registered company.

Remember, it is essential for companies with turnover exceeding AED 375,000 to get registered. On the other hand, a company with exceeding AED 187,500 can also apply for voluntary VAT registration.

Company tax number format consists of 15 digits and is unique for every company also known as “Registrant” in Dubai.

Why is Business Tax Number Important?

Federal Tax Authority (FTA) is a government body that deals in handling VAT matters in UAE such as collecting VAT returns, performing VAT audits, etc…

Check out the list of FTA approved VAT accounting software for business that operates in UAE.

FTA is also responsible for formulating VAT laws in the country and issue fines to those who violate these laws.

Based on these Tax laws, I will discuss a few reasons why business vat number is important:

Collect VAT

Here’s the deal:

If you want to collect VAT, you need to have a value-added tax number.

It is recorded on all your tax invoices with the amount of VAT applicable to your product and services.

Pay VAT

When it comes to purchasing, you’ve got two options:

Option #1: You pay VAT.

Option #2: You do not pay VAT

Here’s how…

You always need to do is find out your invoice has a company tax registration number to pay VAT.

But with no verified company tax number on the invoice, you do not need to pay VAT.

File VAT Return

Think about it:

How FTA will differentiate your VAT return record from other companies?

TRN number!

And if you have your unique TRN number, you file VAT returns using it.

Run VAT Compliance Business

First, you need to figure out that if you must register for VAT.

Question is:

HOW?!

When the turnover of a company exceeds AED 375,000, they must register for VAT and get TRN number

Then, include that number in your documents specified by FTA.

Avoid VAT Fines

Finally, beware of VAT fines.

I’ll explain…

You are a VAT registered company with a vat number and you do not use it according to FTA VAT laws.

Then you will face VAT fines.

That said:

Use your this number on all your financial records.

That’s what is the purpose of the vat number.

It’s no secret that the business vat number is the most important part of VAT in UAE.

In fact…

It is your tax identification number: you need to have one for your company if you want to collect or charge tax during any trade.

Bottom line? If you want to run the VAT compliance business, it is a must.

You might be wondering:

How do I apply for it?

That’s what I’m going to cover in the next chapter.

Keep reading…

How to Apply And Get a Tax Registration Number (TRN) for VAT?

In general, the process to apply for Tax number is the same as registering for VAT in UAE. And I’m going to show you step by step to apply and get a vat number for a new business in Dubai.

If you are free zone company than you should read this VAT registration for Free Zone Companies (2020 Update)

While it is not tough to get, but it needs time and effort.

Again, experienced VAT consultants come in handy here. It will save you time and provide professional help for any issues with registration.

However, you can also get a tax registration number following the given steps:

Create VAT Account

Now that you’ve decided to apply for a VAT number online, it’s time to create your VAT account.

Here’s how:

Go to the portal: https://eservices.tax.gov.ae/en-us/signup

FTA has created a perfect portal to make VAT registration easy.

Simply enter all the details on the given signup form and verify them.

Complete VAT Application Form

VAT application is a form that you need to fill your business details and submit it to the Federal Tax Authority. All the submitted detail and document are reviewed before approval.

Here is how:

First, log in to your VAT account and open the VAT application form. Fill this form and attach the requested document. Then, wait for the approval of your VAT application form.

Here is the list of the most commonly requested documents for registration.

- Trade license copy of the business.

- The partners’ or business owners’ passport copies, ID issued by the Emirates government.

- The owner’s contact details.

- The company’s address (including P.O box) and contact details.

- The company’s Memorandum of Association.

- The bank details of the company.

- The income statement of the company for the past year.

Note: These documents are required for registration for VAT. The number of documents may vary concerning the nature of the business.

Finally, when your application is approved, you get a VAT certificate that has all your business details with your Tax registration number.

Pro Tip: Here’s where you have to be careful. Any incorrect information on the application can create problems for your business.

How Long Does it Take to Get TRN Number?

This is important.

No matter what industry you’re in, the business transaction needs TRN number.

Your submitted VAT registration form and document are reviewed.

It takes 21 working days after the approval of your information to get a TRN.

How Can I Know my VAT Registration Number in UAE?

The VAT registration number is THE most underrated part of the business transactions.

You can have all the perfect financial records.

But if it does not have a valid company VAT number…

…it’s not gonna work.

For example:

When you sell something to your customer, you charge VAT on it.

And it is only possible when you have your company VAT number mentioned on your tax invoice.

But how do you know your Vat reg. number?

That’s why you need to check your VAT certificate carefully.

VAT certificate is an official document containing all your tax-related business details and TRN number. It is issued by the Ministry of Finance to ensure the VAT registration of business under UAE VAT law.

A VAT Certificate holds the following essentials:

- TRN Number or VAT registration number

- The date on which the business entity became VAT registered

- Issue date

- Registered address

- First VAT return period

- VAT return due date

- Start and end dates of tax periods

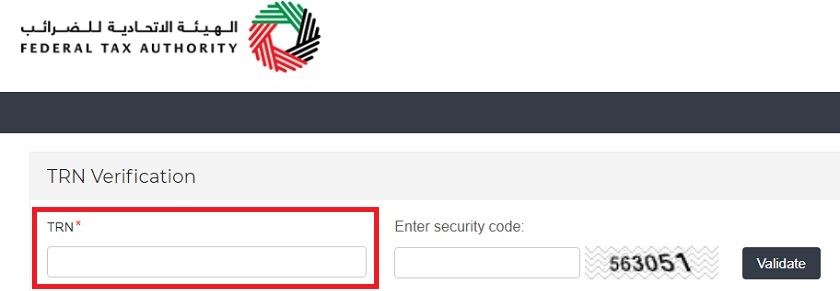

How to Verify a Tax Registration Number of a Company for VAT?

You already know that FTA has a great website to find all VAT information and they have a very cool feature that makes it even more useful.

The website gives you the opportunity to verify and validate any tax registration number.

Here’s how it works.

First, get the tax number of a company

Then go to https://eservices.tax.gov.ae/en-us/trn-verify

Enter the number and security code.

Now press the validate button to check whether the company is vat registered or not.

How do I Find a Company TRN Number?

When it comes to business, there’s one thing I’ve found to be true 100% of the time:

Every VAT registered company has a TRN number.

When you buy from any supplier, request it from the company. You can also find a company TRN number on tax invoices. That’s because, without this number, the company cannot charge VAT.

You can check and verify the number with the above verification method before transaction.

However, you cannot find and verify the tax registration number of any company with its name only.

Bonus: How to avoid VAT fines and get your TRN number?

Let’s face it:

It’s not easy for any business to apply for VAT registration.

According to FTA, there are VAT fines on incorrect information submission.

It gets worse in case incorrect information is submitted for VAT registration:

A fine of AED 5,000 for the first time is issued when a company fails to inform FTA about incorrect information.

And a fine of AED 15,000 in case of repetition

In fact, there is a VAT penalty of AED 20,000 for the late submission of a registration application.

Bottom Line?

It is very important to carefully work on the VAT registration process. If you want to succeed with the VAT registration process, you need professional help.

Here’s how to do it:

Hire VAT Consultant

There’s no way around this:

If you want to avoid VAT fines and get your TRN number, it needs to be done by VAT experts.

Call for VAT Assistance.

Muhammad Asghar: 050 56 98 195