This is a complete guide to Value Added Tax in UAE for new business owners. (2020 update)

Let’s get started.

What is Value Added Tax?

Value-added tax is defined as tax imposed on the consumption of products or services, collected by businesses and delivered to the government.

It is paid by the consumer who buys products and services.

Put another way:

It is a tax that is added to the selling price of products or services.

And is gathered by businesses.

But later the businesses submit it to the government.

The VAT rate is the percentage of sale price that is added to the sale price of products and services.

VAT rate in UAE is 5% for most goods and services except for the exempted or 0% tax categories

For example, let’s say that you sell electronics such as mobile phones, computers, etc…

And you are VAT registered business in UAE

If your price for a laptop is AED 3000, the new price will be AED 3150 (VAT included).

Why VAT Is Introduced?

Now it’s time to figure out WHY it is introduced in UAE.

And the most important reason? Better Public services. The government is responsible for providing better services to its people to improve their lives.

For example, everyone in the country can’t afford to own a car. And rely on public transport. That’s why a better transportation system can facilitate people from different walks of life.

Other examples include social services, healthcare, education and so on.

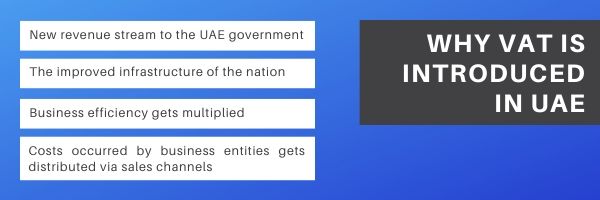

The introduction of VAT will provide financial support to the Government and will be used for developing the country. The image below states some of the other reasons for the its implementation in the UAE.

How Does VAT Work?

Now it’s time to understand how it work in UAE. Since you will be implementing it, you need to make sure that your transactions include tax amount at each step of your business.

Here’s the truth:

Understand VAT is the EASIEST way to quickly save money on VAT returns.

That’s because you can review your transactions in 2 minutes. And adjust your VAT returns with the amount of VAT refunds.

Let’s consider the example of Apple iPhone 11 Pro you are about to sell.

First of all, the journey of this device starts with a manufacturer, who will sell it to the wholesaler. The cost price is AED 3000 and will be sold at AED 3150 at a 5% VAT rate.

Here the manufacturer will collect this amount and submit it to the Government.

As you probably know, the wholesaler will increase the price to include its profit. The new price is AED 3500 and an additional amount of AED 175 will be included at the time of sale.

At this stage, you need to carefully analyze the transactions made by the wholesaler. An important point to remember is that the wholesaler is liable to pay AED 25 to the Government instead of AED 175.

Pro Tip: the better you understand VAT, the easier it will be to minimize the VAT returns of your company.

As you move forward with our supply chain, you can see that the retailer adds its own profit and the new price reaches AED 4200 (VAT included). In fact, this amount is paid by a consumer but it will be the duty of a retailer to submit returns. You can check the details in the diagram below.

Note that the Retailer is liable to pay AED 25 to the Government.

Who Should Apply For VAT Registration in UAE?

There are two types of VAT registration in UAE:

- Mandatory registration

- Voluntary registration

Here’s exactly how to works.

First, find the revenue generated by your business for the previous one year or within the upcoming month.

Why?

Because the Federal Tax Authority has set a mandatory registration threshold of amount AED 375,000. So, your taxable sales and imports within the UAE is more than this threshold value, it is mandatory for you to register.

OK, so what if your revenue is less than AED 375,000.

As it turns out, the Federal Tax Authority has also set a voluntary registration threshold of AED 187,500. In other words, you can still register with revenue greater than AED 187,500.

But what about Startups and small businesses?

They can also apply for voluntary registration under one condition. And that is if their expenses are more than AED 187,500.

Power Tip: Make sure you know the right figures for all taxable sales and imports within the UAE

Important: Are you a free zone company?

If so, you should check VAT registration for Free Zone Companies to find more details.

Here’s What To Do Next…

OK, so I hope this guide helped understand more about Value Added Tax in UAE and who should apply for VAT registration.

And if you still have any questions about VAT, you can directly contact our VAT expert. Here are the details

Muhammad Asghar

Mobile: +971 50 569 8195

Email: asghar (@) hayconsultants.com